Traditional IBORs suffer from outdated tech and fragmented data. FundGuard’s cloud-native investment accounting platform manufactures dynamic multi-asset, multi-jurisdiction, multi-business view accounting data to enrich your IBOR with real-time insights, greater efficiency and unparalleled performance and scalability. Discover how FundGuard can elevate your investment operations.

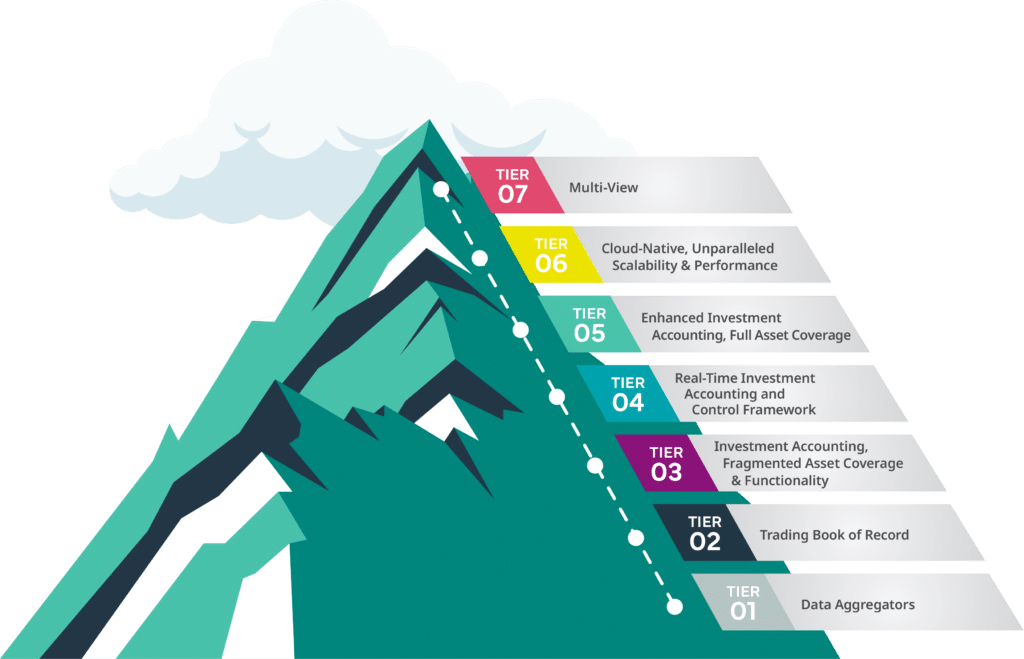

Focus on aggregating data from multiple sources to support reporting, but lack real-time cash, position, and analytics for portfolio managers.

Designed for the front office only, hindering data reconciliation with middle and back offices.

Support specific asset classes with batch processing or API limitations, preventing real-time updates and limiting system upgrades.

Provides real-time (intra-day) security positions, tax lots, and cash to the front office, along with real-time integration through APIs.

Unlocks flexible cash management and forecasting, strategy tagging, multi-manager customization, and automated processing of corporate actions and income.

Seamless growth from a few accounts to thousands across millions of taxlots.

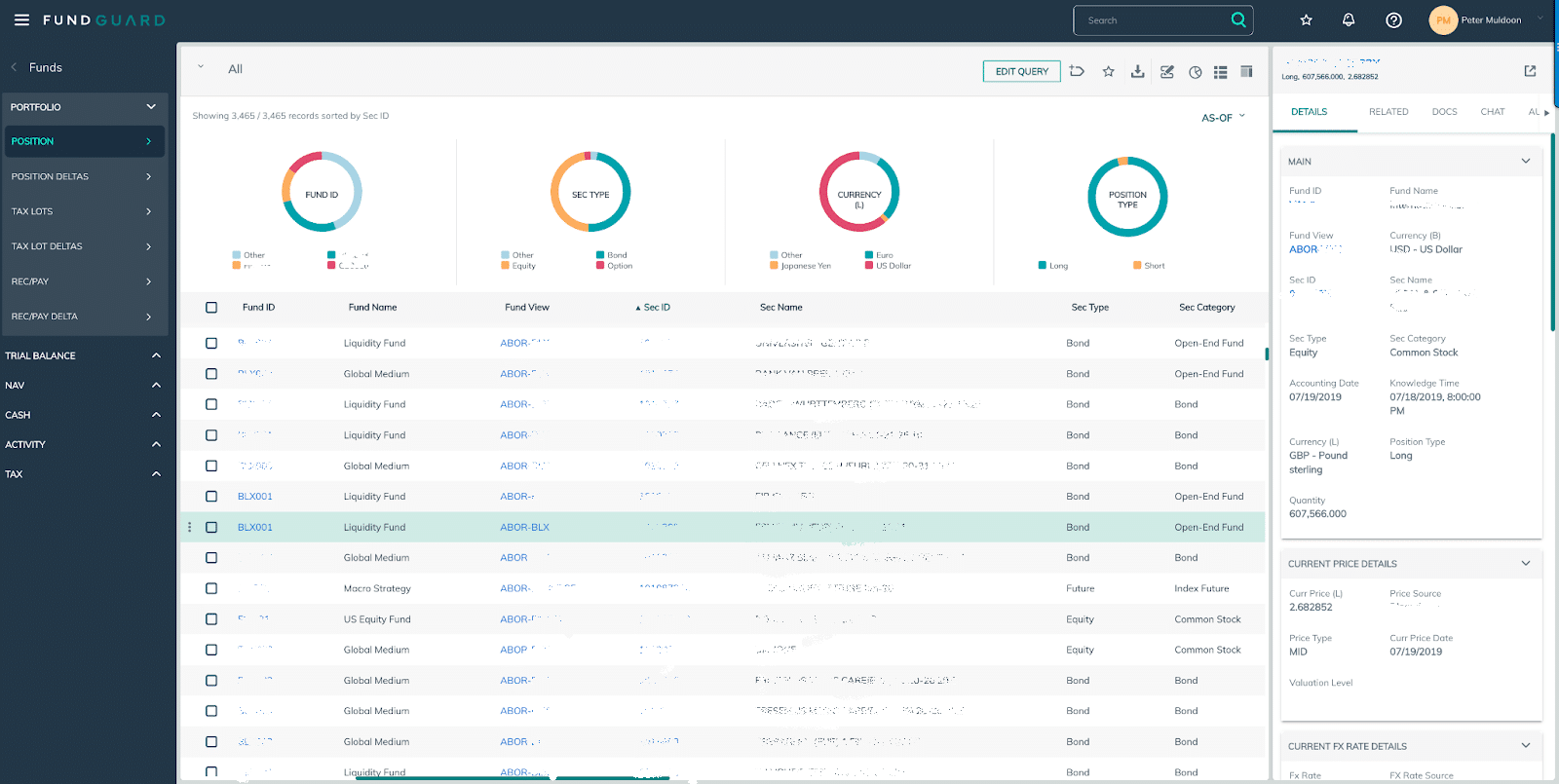

Simultaneous support for IBOR, ABOR and other accounting requirements across all asset classes, jurisdictions and investment products – enabling seamless, real-time alignment across front, middle, and back office with multi-dimensional reporting – and one leveraged system that can be utilized by both the client and/or service provider to support their respective IBOR and ABOR requirements.

FundGuard’s unique tech stack transforms accounting into a real-time data source delivered fit-for-purpose for all business views and enabling a next-level IBOR solution.

FundGuard is uniquely positioned for Tier 7.

APIs with front and middle office systems.

Seamless growth and unparalleled performance.

Supports diverse asset classes (Eq, FI, Derivatives, OTCs, Privates etc.)

Forecasting for various use cases.

Customizable data views.

For corporate actions and income.

Eliminating the redundancies of multiple systems, exponentially reducing costs, and creating unparalleled efficiencies across your investment operations, including simultaneous multi-asset and multi-jurisdiction support for IBOR, ABOR and all downstream business views.

Ready to join the transformation?

100 Bishopsgate

18th Floor

London, EC2N 4AG, United Kingdom

Sign up for FundGuard Insights

Your use of information on this site is subject to the terms of our Legal Notice.

Please read our Privacy Policy.